As tax season approaches, many independent contractors and freelancers are gearing up to file their taxes. One important document they will need is the 1099 form. This form is used to report income earned from self-employment, freelance work, or other sources outside of traditional employment. Understanding how to properly fill out and submit the 1099 form is crucial to avoiding any potential tax issues.

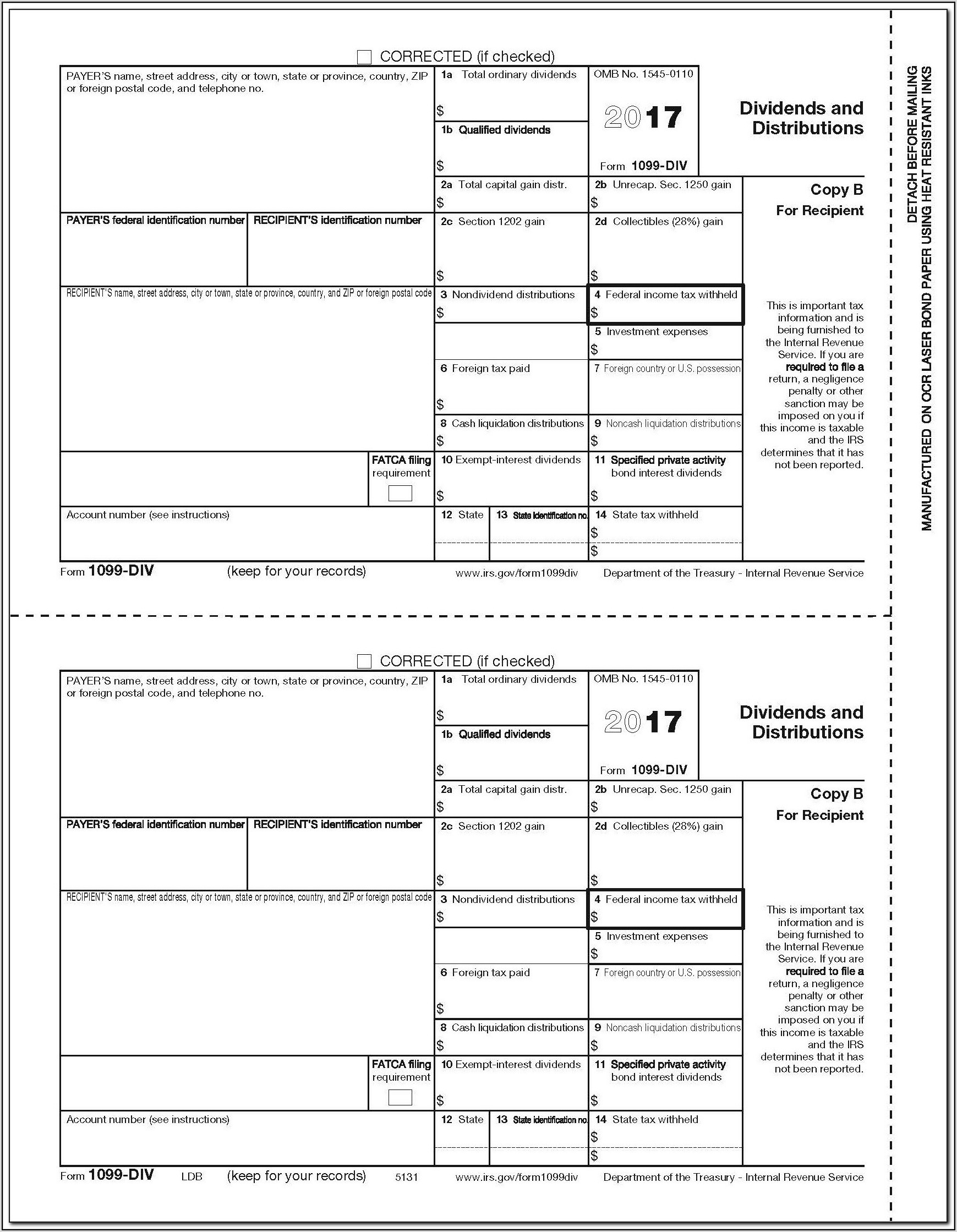

The 1099 form is a document that is used to report income earned by individuals who are not considered employees. This includes income from freelance work, independent contracting, rental income, and more. The form is typically issued by the company or individual who paid you during the tax year, and it must be submitted to the IRS along with your tax return.

Searching for a quick and effective way to manage paperwork? A 1099 Form Printable is the right choice! Whether you’re managing business records, school documents, or home paperwork, Printable Form help you stay organized without relying on digital tools.

Simplify Your Workload with a Printables Form – Quick, Easy, and 100% Free

From resume cover sheets to financial logs and medical records, you can find no-cost printable forms online for almost any need. Just get, prepare, and fill them out on paper—no tools required.

One way to obtain a 1099 form is through the IRS website, where you can download and print the form for free. It is important to ensure that you are using the correct version of the form, as there are different types of 1099 forms depending on the source of income. Once you have the form in hand, you can fill it out with the necessary information, including your name, address, social security number, and the amount of income earned.

When filling out the 1099 form, it is important to double-check all the information to ensure accuracy. Any errors or discrepancies could result in penalties or delays in processing your tax return. Once the form is completed, you can submit it along with your tax return to the IRS. It is recommended to keep a copy of the form for your records in case you need to reference it in the future.

In conclusion, the 1099 form is a crucial document for individuals who earn income from sources outside of traditional employment. By understanding how to properly fill out and submit the form, you can avoid potential tax issues and ensure that your taxes are filed accurately. Be sure to obtain the correct version of the form and double-check all information before submitting it to the IRS. With the right preparation, you can navigate tax season with confidence.