When it comes to filing taxes, having the right forms is crucial. The Internal Revenue Service (IRS) provides a variety of printable forms that individuals and businesses can use to report their income, expenses, and deductions. These forms are essential for accurately calculating and paying taxes each year.

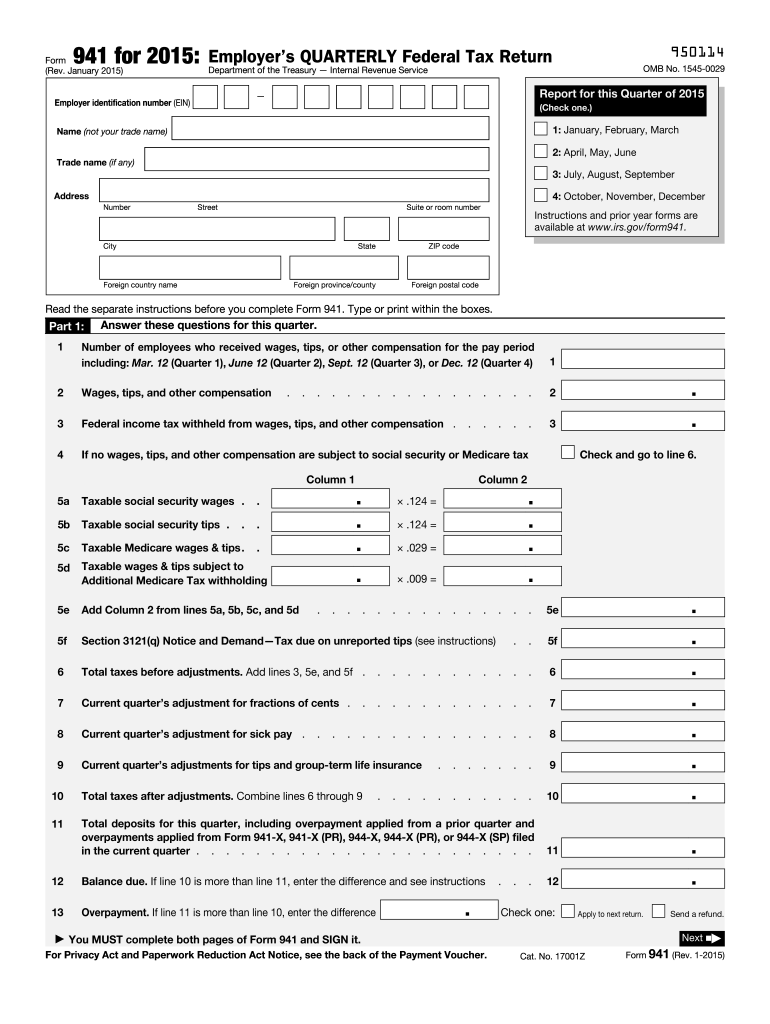

Whether you are a first-time filer or a seasoned taxpayer, understanding the different IRS printable forms is important. From Form 1040 for individual income tax returns to Form 941 for employer’s quarterly federal tax return, there is a form for every type of taxpayer and situation.

Need a quick and efficient way to process forms? A Printable Form is the right choice! Whether you’re managing business records, educational forms, or personal files, Irs Gov Printable Formsthese forms help you maintain order without relying on digital tools.

Organize Your Processes with a Printable Form – Instant, Easy, and No-Cost

From employment forms to budget sheets and medical records, you can find complimentary printables form on the web for almost any need. Just get, prepare, and fill them out by hand—no special software required.

IRS Gov Printable Forms

One of the most commonly used IRS printable forms is Form W-4, Employee’s Withholding Certificate. This form is used by employees to determine the amount of federal income tax to be withheld from their paychecks. By accurately completing this form, employees can ensure that the right amount of tax is withheld throughout the year.

Another important form is Form 1099-MISC, Miscellaneous Income. This form is used by businesses to report payments made to non-employees, such as contractors and freelancers. It is essential for businesses to accurately report these payments to avoid penalties and ensure compliance with tax laws.

For individuals who receive income from sources other than wages, Form 1099-NEC, Nonemployee Compensation, is used to report such income. This form is commonly used by self-employed individuals and independent contractors to report income received for services rendered.

In addition to these forms, the IRS also provides printable forms for various credits and deductions, such as the Earned Income Tax Credit (EITC) and the Child Tax Credit. These forms allow taxpayers to claim credits and deductions that can reduce their tax liability and increase their tax refunds.

Overall, IRS Gov printable forms play a crucial role in the tax-filing process. By using the right forms and accurately reporting income, expenses, and deductions, taxpayers can ensure compliance with tax laws and avoid penalties. It is important to review the IRS website regularly to stay updated on any changes to tax forms and requirements.

So, whether you are an individual taxpayer or a business owner, make sure to use the appropriate IRS printable forms to accurately report your tax information and avoid any potential issues with the IRS.